Anniversary of the UP-MKT Merger

Aug 12, 2017 Filed in: Prototype Research

Today, 29 years ago, the Missouri-Kansas-Texas and Union Pacific Railroad merger was finalized.

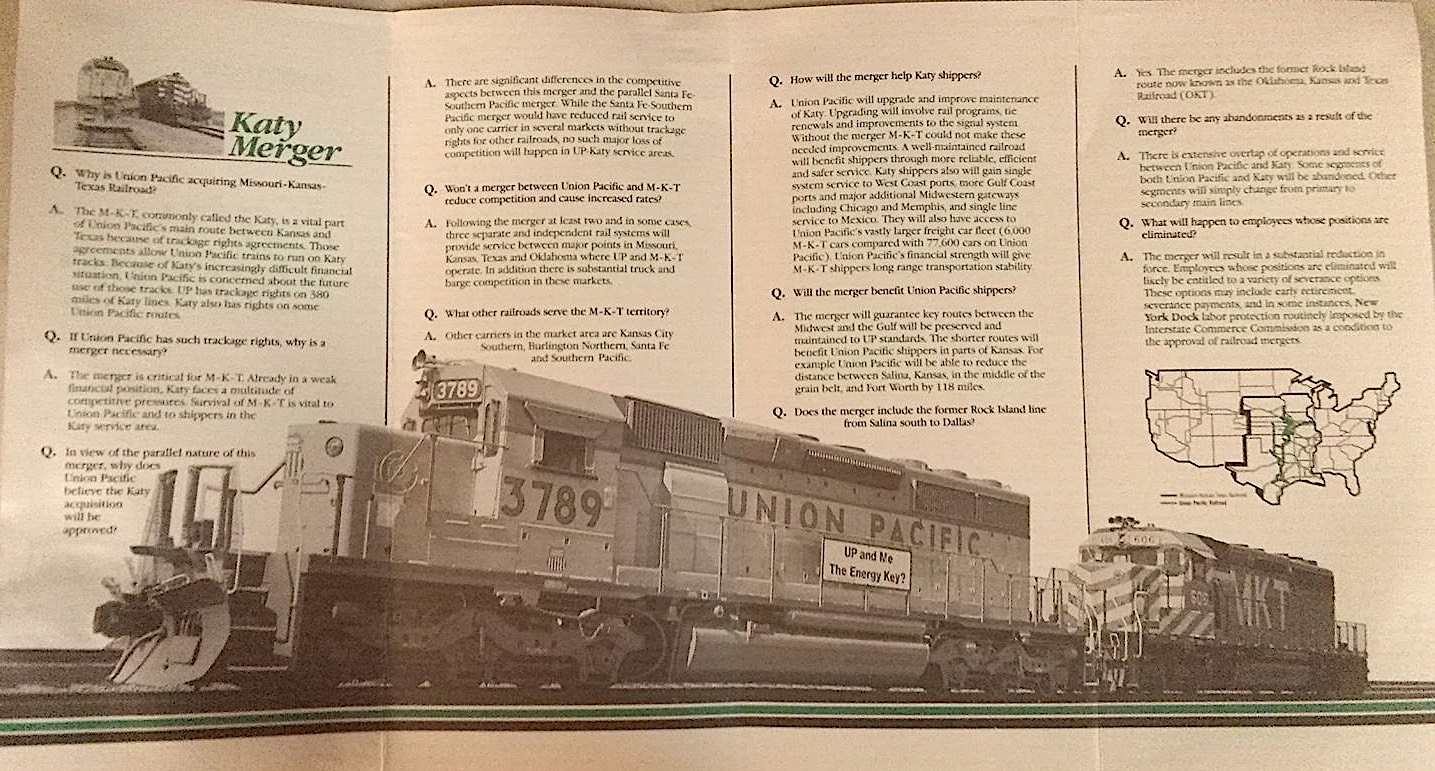

I recently came across a flyer describing the Katy Merger, and found it very interesting. The photos are a bit blurry, so I have transcribed the text:

Why is Union Pacific acquiring Missouri–Kansas–Texas Railroad?

The M-K-T, commonly call the Katy, is a vital part of Union Pacific's main route between Kansas and Texas because of trackage rights agreements. Those agreements allow Union Pacific trains to run on Katy tracks. Because of Katy's increasingly difficult financial situation, Union Pacific is concerned about the future of those tracks. UP has trackage rights on 380 miles of Katy lines. Katy also has rights on some Unopn Pacific routes.

If Union Pacific has such trackage rights, why is a merger necessary?

The merger is critical for M-K-T. Already in a weak financial position, Katy faces a multitude of competitive pressures. Survival of M-K-T is vital to Union Pacific and to shippers in the Katy service area.

If Union Pacific has such trackage rights, why is a merger necessary?

There are significant differences in the competitive aspects between this merger and the parallel Santa Fe-Southern Pacific merger. While the Santa Fe-Southern Pacific merger would have reduced rail service to only one carrier in several markets without trackage rights for other railroads, no such major loss of competition will happen in UP-Katy service areas.

Won't a merger between Union Pacific and M-K-T reduce competition and cause increased rates?

Following the merger at least two and in some cases, three separate and independent rail systems will provide service between major points in Missouri, Kansas, Texas, and Oklahoma where UP and M-K-T operate. In addition there is substantial truck and barge operation in these markets.

What other railroads serve the M-K-T territory?

Other carriers in the market are are Kansas City Southern, Burlington Northern, Santa Fe, and Southern Pacific.

How will the merger help Katy shippers?

Union Pacific will upgrade and improve maintenance of Katy. Upgrading will involve rail programs, tie renewals and improvements to the signal system. Without the merger M-K-T could not make these needed improvements. A well-maintained railroad will benefit shippers through more reliable, efficient and safer service. Katy shipper will also gain single system service to West Coast ports, more Gulf Coast ports and major additional Midwestern gateways including Chicago and Memphis, and single line service to Mexico. They will also have access to Union Pacific's vastly larger freight car fleet (6,000 M-K-T cars compared with 77,600 cars on the Union Pacific). Union Pacific's financial strength will give M-K-T shippers long range transportation stability.

Will the merger benefit Union Pacific shippers?

The merger will guarantee key routes between the Midwest and the Gulf will be preserved and maintained to UP standards. The shorter routes will benefit Union Pacific shippers in parts of Kansas. For example Union Pacific will be able to reduce the distance between Salina, Kansas, in the middle of the grain belt, and Fort Worth by 118 miles.

Doe the merger include the former Rock Island line from Salina south to Dallas?

Yes. The merger includes the former Rock Island route now known as the Oklahoma, Kansas and Texas Railroad (OKT).

Will there be any abandonment as a result of the merger?

There is extensive overlap of operations and service between Union Pacific and Katy. Some segments of both Union Pacific and Katy will be abandoned. Other segments will simply change from primary to secondary main lines.

What will happen to employees whose positions are eliminated?

The merger will result in a substantial reduction in force. Employees whose positions are eliminated will likely be entitled to a variety of severance options. These options may include early retirement, severance payments, and in some instances, New York Dock labor protection routinely imposed by the Interstate Commerce Commission as a condition to the approval of railroad mergers.

What are the terms of the agreement?

Union Pacific will pay $110 million for the Katy and will assume $256 million in outstanding debts.

Why was the plan to acquire the Katy announced, then cancelled?

Union Pacific had reached an agreement in 1985 to acquire the Katy, but the deal was cancelled when the Katy was unable to acquire a specified number of registered certificates that had been issued when the railroad was reorganized in 1958. Under the terms of the certificates, the M-K-T is prohibited from paying dividends until 60 percent of the certificates are redeemed. A new offer to acquire a sufficient number of certificates has succeeded, allowing the agreement to go forward.

When will the merger take place?

By statue, the Interstate Commerce Commission has up to 31 months to act following the filing of a merger application. The application to acquire the Katy was filed Nov 14, 1986. Union Pacific requested the commission adopt an expedited schedule. The commission has approved this request with hearings scheduled to begin August 3, 1987. A decision is expected in early 1988.